Enhancing Financial Knowledge for Sustainable Growth in Mongolia

Economy

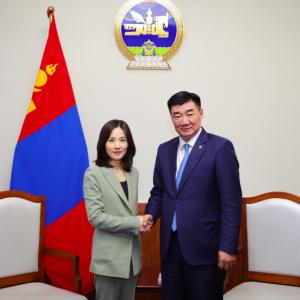

Ulaanbaatar, June 8, 2023 /MONTSAME/. A medium-term program aimed at enhancing the financial knowledge of businessmen in micro, small, and medium-sized enterprises (MSMEs), as well as service providers is being jointly implemented by the Bank of Mongolia, the Ministry of Agriculture, Food and Light Industry, Financial Regulatory Commission, the Small and Medium-sized Enterprise Service Support Center in Ulaanbaatar city, the Credit Guarantee Fund, the Deposit Insurance Corporation, and the Mongolian National Chamber of Commerce and Industry.

Under

the joint order of the Minister of Food, Agriculture and Light Industry and the

President of the Bank of Mongolia, a medium-term program was approved and

as part of this program, training sessions have been organized across 21 aimags

to empower local business communities of MSMEs with improved financial

knowledge.

Last year,

approximately 1,700 service providers of MSMEs from 9 districts of the capital participated

in the training. This year, the training expanded to include service providers

from 21 aimags.

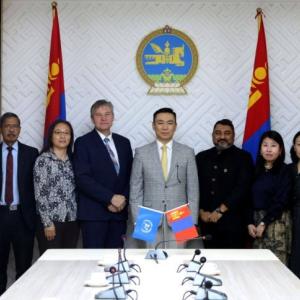

The training sessions

covered various topics, including the procedures for accessing concessional loans from

the SME Development Fund and the Cooperative Development Fund, a wide range of financial products, and effective communication with financial institutions.

The training

sessions were carried out also within the framework of the "Program to

Support the Economic Diversification of Mongolia by Increasing Access to Small

and Medium-sized Businesses" being implemented by the EBRD, with funding

provided by the European Union and the participants gained

insights into available

business support and assistance programs, financial risk management strategies

during times of crisis, e-commerce practices, payment methods, and investment

opportunities.

The participants expressed their interest to have training that covers topics such as corporate governance, business project development, enterprise finance, and tax reporting as well as addresses specific areas like agriculture, packaging, diversifying sales channels, optimizing revenue generation, efficient loan utilization, human resources, insurance, financial management, marketing strategies, the production of export-oriented products and cluster development.

The medium-term program serves as a coordinated effort to improve economic and financial stability and development, safeguard the interests of financial consumers, and ensure proper management of personal and financial affairs by eliminating duplication and ensuring mutual coordination in activities targeted to enhancing the financial knowledge of MSMEs businessmen.

Ulaanbaatar

Ulaanbaatar