Credit repayments to commercial banks decreased by 53.5 percent

Economy

Ulaanbaatar/MONTSAME/. At the end of April 2020, the total

amount of outstanding loan to entities and individuals amounted to MNT 17.2

trillion, increased by MNT 7.6 billion (0.04%) from the previous month, but decreased by MNT 514.5 billion (2.9%) from the same period of the

previous year. In the total outstanding loans, MNT 8.7 trillion (50.9%) was

individual loans.

The performing loans reached MNT 14.0 trillion at the end of

April 2020, decreased by MNT 187.4 billion (1.3%) from the previous month, and

by MNT 762.5 billion (5.2%) from the same period of the previous year. The

performing loans make up 81.5% of total loans, showing a decrease of 1.9 points

from the same period of the previous year.

At the end of April 2020, the principals in arrears amounted

to MNT 1.3 trillion, increased by MNT 158.0 billion (13.7%) from the previous

month, and by MNT 328.0 billion (33.5%) from the same period of the previous

year. The principals in arrears make up 7.6% of total loans, showing an increase

of 2.1 points from the same period of the previous year.

At the end of April 2020, the non-performing loans in the

banking system amounted to MNT 1.9 trillion, increased by MNT 37.0 billion

(2.0%) from the previous month, while it is decreased by MNT 80.0 billion

(4.1%) from the previous year. The non-performing loans in the banking system

make up 10.9% of total loans, showing a decrease of 0.1 points from the same

period of the previous year.

By type of outstanding loans of individuals, 40.4 percent were

mortgage loans, 26.1 percent -- salary loans, 14.8 percent -- small and medium

enterprises loans, 11.6 percent -- consumer loans, 1.4 percent -- pension loan,

and 5.7 percent -- others. Commercial banks correspond to 73.8% of the total

outstanding loans to individuals.

At the end of March 2020, credit repayments to commercial

banks by individuals reached MNT 608.6 billion, decreased by MNT 701.4 (53.5%)

compared to the same period of the previous month and by MNT 68.6 billion

(10.3%) compared to the same period of the previous year. For loan repayment, mortgage

loan repayment was 3.9% (MNT 23.7 billion), small and medium business loans was

17.1% (MNT 103.8 billion), consumer loans was 23.8% (MNT 144.9 billion), salary

loans was 20.4% (MNT 124.1 billion) and 5.8% (MNT 35.5 billion) of pension

loans and 29.0% (MNT 176.5 billion) was other loans.

Source: National Statistics Office

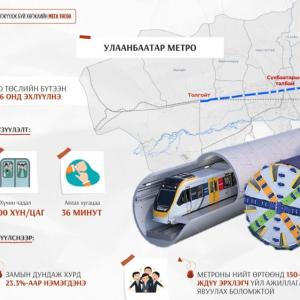

Ulaanbaatar

Ulaanbaatar