Non-performing loans in banking system increased by 0.6 percent

Economy

Ulaanbaatar/MONTSAME/. At the end of January 2020, the total

amount of outstanding loans to entities, enterprises and citizens amounted to

MNT 18.1 trillion, increased by MNT 871.7 billion (5.1%) from the same period

of the previous year. From the total outstanding loans, MNT 9.4 trillion

(52.2%) was loaned to individuals, MNT 8.6 trillion (47.8%) was loaned to

enterprises.

At the end of January 2020, the non-performing loans in the

banking system amounted to MNT 1.8 trillion, increased by MNT 10.3 billion

(0.6%) from the previous month, and increased by MNT 47.5 billion (2.7%) from

the previous year. The non-performing loans in the banking system make up to

10.2% of total loans, showing a decrease of 0.2 points from the same period of

the previous year.

At the end of December 2019, the outstanding loans to

individuals amounted to MNT 12.1 trillion, increased by MNT 16.9 billion (0.1%)

from the previous month and increased by MNT 370.2 billion (3.1%) from the same

period of the previous year.

In the total loans, 38.1 percent was mortgage loans, 25.8

percent was salary loans, 13.6 percent was small and medium enterprises loans,

10.3 percent was consumer loans, 6.2 percent was pension loan, and 5.9 percent

was other loans. Here, 76.3% of the total outstanding loans to individuals were

from commercial banks.

At the end of December 2019, the loans to small and medium

enterprises and individuals amounted to MNT4.0 trillion, increased by MNT 1.7

billion (0.04%) from the previous month, and increased by MNT 634.6 billion

(18.4%) from the same period of the previous year.

Source: National Statistics Office

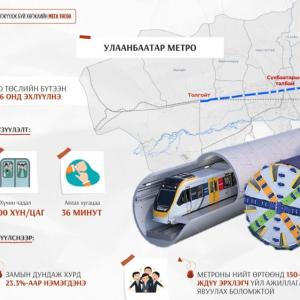

Ulaanbaatar

Ulaanbaatar