Parliament Speaker visits Mongolian Stock Exchange

Politics

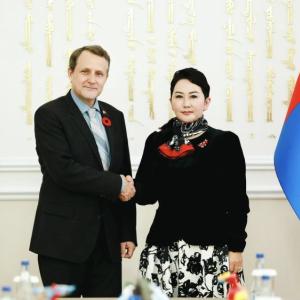

Ulaanbaatar/MONTSAME/. On September 20,

Parliament Speaker G. Zandanshatar visited the Mongolian Stock Exchange, exchanged

views on the current state and future prospects of the stock market, and rang

the opening bell. Chairman of Financial Regulatory Commission D. Bayarsaikhan, Vice-Chairmen

of FRC T. Tserenbadral and N. Khuderchuluun, Chief Executive of FRC T.

Jambaajamts, CEO of the Mongolian Stock Exchange Kh. Altai and other officials

attended the bell ceremony.

In his opening speech, D. Bayarsaikhan highlighted, “The FRC has

undertaken the following measures in order to develop the capital market,

increase the number of new products and services, enhance securities trade and

liquidity, and increase investors’ trust within the framework of ‘Developing

the capital market and reducing financing costs by promoting competition’

reflected in the ‘Strategy to Reduce Loan Interest Rate’ adopted by the

Parliament of Mongolia.

Pursuant to international standards, Delivery versus Payment and

the T+2 Settlement System were successfully introduced in order to enhance the

capital market infrastructure.

A regulatory framework for dual-listing in which companies

convert securities between domestic and foreign exchanges freely was created.

Within the scope of promoting the corporate bond market and

forming a new market for professional investors, the Regulations of the

Over-the-counter (OTC) Market was adopted in 2020. Thus, currently, two systems

including exchanges and OTC markets were formed in the capital market.

To form a regulatory environment where local entities could

raise funds by issuing IPOs and corporate bonds, an existing regulation was

separated into two ones: the Regulation on Securities Registration and the

Regulation on Bonds Registration. As a result, issuing public offerings has

become easier, faster, and more cost-effective.

The Regulation on Investment Fund and the Regulation on

Investment Management Company were improved to meet the international standard,

in the scope of increasing the participation of professional investors. It

leads to an increase in mutual public and private investment funds and

exchange-traded funds.

As a result, in 2021, market capitalization reached MNT6.0

trillion (an increase of 95.8% compared

to 2020), and constituted 15.3% of GDP. Securities trades

reached MNT1.4 trillion (a 21.6-fold increase since 2020); the highest ever

level in the 30-year history of the capital market in Mongolia. The country is

now considered to have the fastest-growing stock market in the world.

In addition, 66 corporate bonds (with a total value of MNT1.1

trillion) of 52 enterprises were registered, and more than MNT670 billion of

funds were successfully raised over the previous year. Furthermore, 44 new

financial products (including mutual investment funds, asset-backed securities

for commercial purposes, digital bonds, bank IPO – Bogd bank, public investment

fund, and others) were issued in the capital market.”

At the end of his speech, D. Bayarsaikhan emphasized that, in

cooperation with respective authorities, the FRC will continue to take further

measures to reform the legal and regulatory environment of the securities

market and the privatizing of state-owned companies through exchanges. This

development should lead to an increase in the role of the capital market in the

economy, increase the level of competitiveness in the region, reinforce

previous accomplishments, intensify future activities and increase investors’

trust.

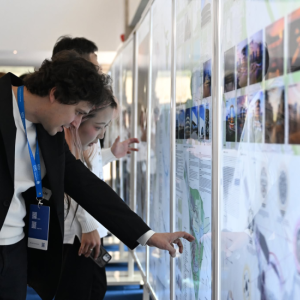

During the ceremony, B. Dulguun (Director, Securities Market

Department, FRC) presented the ‘Capital Market Overview, Development Policy and

Regulation.’

Source: Financial Regulatory Commission of Mongolia

Ulaanbaatar

Ulaanbaatar