Tax revenue reaches MNT4.5 trillion, with 33 percent increase

Economy

Ulaanbaatar/MONTSAME/ In the first 7 months of 2018, total equilibrated revenue and grants of the General Government Budget reached MNT 5.0 trillion, and total expenditure and net lending amounted to MNT 4.8 trillion. In the first 7 months of 2017, the equilibrated balance was in deficit of MNT 589.4 billion, however, it is in surplus of MNT 291.3 billion in the first 7 months of 2018.

Tax revenue reached MNT 4.5 trillion, increased by MNT 1.1 trillion or 33.0 percent compared to the same period of the previous year. This growth was mainly influenced by increases of MNT 291.6 billion or 34.1 percent in value added tax, MNT 277.7 billion or 31.5 percent in income tax, MNT 168.4 billion or 68.5 percent in excise taxes, MNT 145.0 billion or 20.5 percent in social security income, MNT 108.5 billion or 33.0 percent in other taxes and MNT 102.8 billion or 39.0 percent in revenue of foreign activities.

The General Government revenue accounted for 79.6 percent of tax revenue, 10.3 percent of non-tax revenue, 7.3 percent of the future heritage fund and 2.8 percent of stabilization fund.

In the first 7 months of 2018, total expenditure and net lending of the General Government Budget amounted to MNT 4.8 trillion, increased by MNT 271.9 billion or 6.1 percent compared to the same period of the previous year. This growth was caused by increases of MNT 199.5 billion or 5.2 percent in current expenditure, MNT 76.0 billion or 69.5 percent in net lending, even though there was a decrease of MNT 3.6 billion or 0.6 percent in capital expenditure compared to the same period of the previous year.

The General Government expenditure and net lending accounted for 84.3 percent of current expenditure, 11.8 percent of capital expenditure and 3.9 percent of net lending.

Tax revenue reached MNT 4.5 trillion, increased by MNT 1.1 trillion or 33.0 percent compared to the same period of the previous year. This growth was mainly influenced by increases of MNT 291.6 billion or 34.1 percent in value added tax, MNT 277.7 billion or 31.5 percent in income tax, MNT 168.4 billion or 68.5 percent in excise taxes, MNT 145.0 billion or 20.5 percent in social security income, MNT 108.5 billion or 33.0 percent in other taxes and MNT 102.8 billion or 39.0 percent in revenue of foreign activities.

The General Government revenue accounted for 79.6 percent of tax revenue, 10.3 percent of non-tax revenue, 7.3 percent of the future heritage fund and 2.8 percent of stabilization fund.

In the first 7 months of 2018, total expenditure and net lending of the General Government Budget amounted to MNT 4.8 trillion, increased by MNT 271.9 billion or 6.1 percent compared to the same period of the previous year. This growth was caused by increases of MNT 199.5 billion or 5.2 percent in current expenditure, MNT 76.0 billion or 69.5 percent in net lending, even though there was a decrease of MNT 3.6 billion or 0.6 percent in capital expenditure compared to the same period of the previous year.

The General Government expenditure and net lending accounted for 84.3 percent of current expenditure, 11.8 percent of capital expenditure and 3.9 percent of net lending.

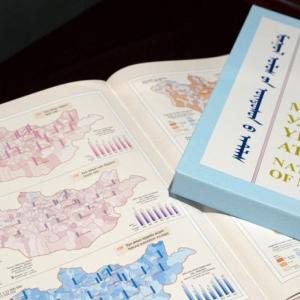

Source: National Statistics Office of Mongolia

Ulaanbaatar

Ulaanbaatar