Package of draft laws on tax discussed

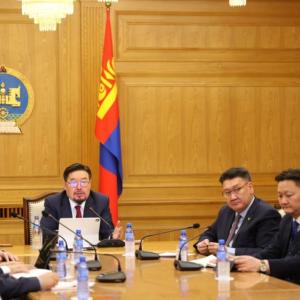

EconomyUlaanbaatar/MONTSAME/ On February 18, the State House organized a

discussion to present the package of draft laws on tax. Until today, the

Ministry of Finance has carried out a discussion on the same topic 39 times

since February 2018, which involved 4,790 people.

The package of draft laws aims to support

taxpayers, to encourage them to pay taxes in due times and to provide the

trustful payers with premiums. Moreover, the package includes clauses on

fighting with tax avoidance and unfair payers, said Ch.Khurelbaatar, Minister of

Finance, in his report during the discussion.

B.Battumur

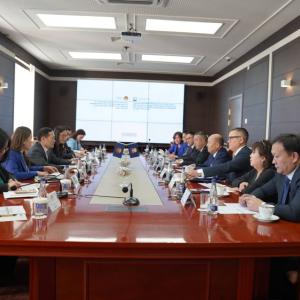

MP pointed out the package will be submitted soon to the parliamentary session

for a discussion of a plenary meeting. He said, “A working group has been set

up by a Speaker’s ordinance to prepare the package of the draft laws for a

meeting of the relevant Standing committee and a plenary meeting of the

parliamentary session. We are scrutinizing proposals on the package laws given

from individuals, governmental bodies, NGOs and enterprises.”

Concerning

some noticeable matters on the package of draft laws, acting head of the General Department of Taxation B.Zayabal said: “By the draft, a general system of taxation

management is projected to be introduced in order to convert the existing tax

report card system into online. It will make the individuals’ income tax

reporting simpler and easier. It also will allow registering foreign

individuals and enterprises in the income taxation system. Furthermore, tax

return of the VAT will be provided quarterly as well.”

Ch.Khurelbaatar, Minister of Finance, pointed out the

package of the draft laws has a clause that permits entities with annual income

below MNT 50 million to pay one-percent tax and give a simplified report once a

year. He said that the tax laws have been altered after the Finance Ministry

had analyzed all views and proposals.

B.Lkhagvajav, Chairman of the Board and President of MNCCI, said: “New wordings of the laws on VAT,

on audit and on accounting came into force from January 1st 2016. These new wordings

were supposed to correlate with the package of tax laws, but they are still in

discussion with no approval yet. A forecast shows the Mongolian economic growth

will double in 2021 from the current size. Therefore, the above laws will

become vital to make the tax environment better in order to progress the

current economy. The VAT lottery system contributed to maximizing the

governmental budget, exceeding by MNT 2.2 trillion. Likewise, the simplified

tax reporting of small and medium-sized entities will definitely give positive

impact on the national economy. By the law on individuals’ income tax, the tax

discount should be simplified like the VAT tax return. If we implement it

successfully, Mongolia will become a country with the easiest tax system in

central Asia.”

An economist

J.Delgersaikhan said: “Articles and clauses in the

package of the draft laws are fully harmonized with the present economic

environment. The tax payment and return matters are clearly reflected in the

laws. It simply means the amended laws will provide fair taxpayers with many

advantages.”

source: mongolchamber.mn

Ulaanbaatar

Ulaanbaatar