IFC supports insolvency reform in Mongolia

Economy

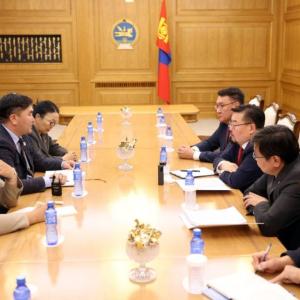

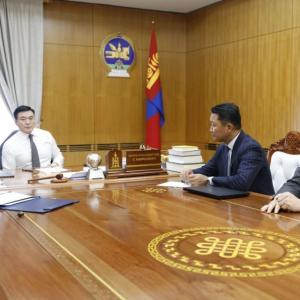

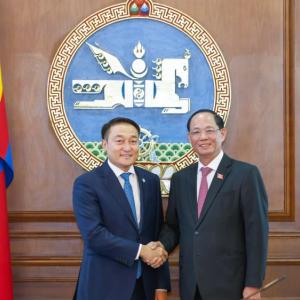

Ulaanbaatar /MONTSAME/ On November 27, IFC, a member of the World Bank Group, signed a Memorandum of Understanding with the Ministry of Justice and Home Affairs (MOJHA) of Mongolia to help reform the country’s bankruptcy framework. It further aims to improve access to finance and ensure financial stability in the country by strengthening the insolvency and debt collections system.

The reform is intended to enable the Mongolian credit industry to manage debtor insolvencies and collections in more effective, efficient and responsible ways. It will strengthen a critical piece of financial infrastructure, particularly for the financing of micro, small and medium enterprises (MSMEs). It will also complement other areas of reforms that are being undertaken by the government to drive economic growth.

Going ahead, the project will focus on strengthening the legal and regulatory framework by updating the current bankruptcy law. In addition, it will develop capacities and standards for Mongolian insolvency professionals and promote non-judicial means of insolvency resolutions and improving debt collection standards.

"Strengthening bankruptcy legislation and improving the debt resolution system is one of the key elements of the government's plan to modernize Mongolia's legal framework by 2020. A good insolvency framework will facilitate the quick resolution of non-performing assets in the banking industry, support entrepreneurship and provide confidence to investors", said G. Bayasgalan, State Secretary of MOJHA, "With IFC's help, we will be able to incorporate international best practice in this reform and train a critical mass of insolvency professionals".

"We are pleased to start this new initiative with our partner MOJHA," said Tuyen D. Nguyen, IFC Resident Representative in Mongolia. He added, "International experience suggests that insolvency framework is a necessary foundation for the financial markets to function efficiently and safely. Most importantly, it will provide rules and standards for a quick resolution of the overly indebted individuals and SMEs, and enable the creditors to exit from problem loans in an orderly fashion."

This project in Mongolia is being supported by a Korea Trust Fund in the World Bank Group. IFC has successfully assisted dozens of financial infrastructure reforms in emerging markets related to secured transactions and movable asset finance development, credit reporting system, and bankruptcy and debt collection framework. Effective insolvency system helps to reduce uncertainty and potential risks faced by lenders and investors with predictable debt collection and recovery process. It also supports entrepreneurship by giving the insolvent business individuals reasonable exits and a fresh re-start.

The reform is intended to enable the Mongolian credit industry to manage debtor insolvencies and collections in more effective, efficient and responsible ways. It will strengthen a critical piece of financial infrastructure, particularly for the financing of micro, small and medium enterprises (MSMEs). It will also complement other areas of reforms that are being undertaken by the government to drive economic growth.

Going ahead, the project will focus on strengthening the legal and regulatory framework by updating the current bankruptcy law. In addition, it will develop capacities and standards for Mongolian insolvency professionals and promote non-judicial means of insolvency resolutions and improving debt collection standards.

"Strengthening bankruptcy legislation and improving the debt resolution system is one of the key elements of the government's plan to modernize Mongolia's legal framework by 2020. A good insolvency framework will facilitate the quick resolution of non-performing assets in the banking industry, support entrepreneurship and provide confidence to investors", said G. Bayasgalan, State Secretary of MOJHA, "With IFC's help, we will be able to incorporate international best practice in this reform and train a critical mass of insolvency professionals".

"We are pleased to start this new initiative with our partner MOJHA," said Tuyen D. Nguyen, IFC Resident Representative in Mongolia. He added, "International experience suggests that insolvency framework is a necessary foundation for the financial markets to function efficiently and safely. Most importantly, it will provide rules and standards for a quick resolution of the overly indebted individuals and SMEs, and enable the creditors to exit from problem loans in an orderly fashion."

This project in Mongolia is being supported by a Korea Trust Fund in the World Bank Group. IFC has successfully assisted dozens of financial infrastructure reforms in emerging markets related to secured transactions and movable asset finance development, credit reporting system, and bankruptcy and debt collection framework. Effective insolvency system helps to reduce uncertainty and potential risks faced by lenders and investors with predictable debt collection and recovery process. It also supports entrepreneurship by giving the insolvent business individuals reasonable exits and a fresh re-start.

Ulaanbaatar

Ulaanbaatar