Meeting addresses SMEs access to finance in Mongolia

Economy

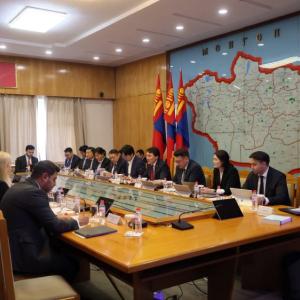

Ulaanbaatar /MONTSAME/ The European Bank for Reconstruction and Development (EBRD) in Mongolia is holding a donor coordination meeting today, June 13, to address the current situation, obstacles in and solutions to SMEs access to finance in the country.

The meeting is being held within the framework of the EBRD-implemented programme ‘Support for Mongolian economic diversification through SME access to finance’, in cooperation with the Mongolian Ministry of Food, Agriculture and Light Industry, the main beneficiary and partner of the programme which is funded under the European Union’s Asia Investment Facility.

Aiming to build synergies between current programmes of donor assistance in SME development and access to finance, disseminate information about the government’s priorities for SME development, and identify areas for future assistance, the coordination meeting is attended by about 60 national and international stakeholders, representing the donor community active in the area of SME development in Mongolia, government officials and representatives of the private sector.

“The donor coordination meeting addresses a timely agenda”, remarked L.Bayartulga, Secretary of State at the Ministry of Food, Agriculture and Light Industry during his opening speech. Lars Groenvald, Head of Cooperation at the EU Delegation to Mongolia and China was also present at the meeting to deliver an opening speech.

Key presentation of the coordination meeting focused on the Mongolian government’s policy priorities on SME development in Mongolia.

Mongolia adopted a SME law in 2007. Although several other legislations including financial leasing law, employment promotion law and credit guarantee fund law are being realized to create a favorable legal and business environment for SMEs, there is a necessity to take other measures to ensure SME growth.

“The Mongolian Government prioritizes enhancing the legal environment surrounding SME development, improving SME access to finance and boosting SME competitiveness” Secretary of State Battulga said, mentioning policy measures that are seen crucial in fulfilling the objectives.

The agenda also includes an overview of findings from a recent survey on the issue of SME access to finance conducted by the Organization for Economic Cooperation and Development (OECD) last year, in frames of its Enhancing Access to Finance for MSMEs in Mongolia project.

As found by the survey, 5 major issues that hamper MSMEs to access finance in Mongolia are availability of data on MSMEs, loan offer (maturity, interest rate, size), collateral, process to obtain a loan and financial literacy.

“The OECD team in collaboration with the representatives of public and private sectors came up with the best policy recommendations to enhance access to finance for MSMEs”, said E.Buyanchimeg, Local consultant at OECD.

Five priority policies corresponding to the five obstacles are aligning statistics on MSMEs with the OECD SME Financial Scoreboard; diversifying the products offered by the SME Development Fund; overcoming the collateral issue by enhancing the operation of the Mongolian Credit Guarantee Fund; streamlining administrative procedures for loan applications; and improving financial education by ensuring the national strategy is tailored to MSMEs.

As such, the donor coordination meeting also facilitates a panel discussion on donors’ inputs on addressing the issues of SME access to finance.

The meeting is being held within the framework of the EBRD-implemented programme ‘Support for Mongolian economic diversification through SME access to finance’, in cooperation with the Mongolian Ministry of Food, Agriculture and Light Industry, the main beneficiary and partner of the programme which is funded under the European Union’s Asia Investment Facility.

Aiming to build synergies between current programmes of donor assistance in SME development and access to finance, disseminate information about the government’s priorities for SME development, and identify areas for future assistance, the coordination meeting is attended by about 60 national and international stakeholders, representing the donor community active in the area of SME development in Mongolia, government officials and representatives of the private sector.

“The donor coordination meeting addresses a timely agenda”, remarked L.Bayartulga, Secretary of State at the Ministry of Food, Agriculture and Light Industry during his opening speech. Lars Groenvald, Head of Cooperation at the EU Delegation to Mongolia and China was also present at the meeting to deliver an opening speech.

Key presentation of the coordination meeting focused on the Mongolian government’s policy priorities on SME development in Mongolia.

Mongolia adopted a SME law in 2007. Although several other legislations including financial leasing law, employment promotion law and credit guarantee fund law are being realized to create a favorable legal and business environment for SMEs, there is a necessity to take other measures to ensure SME growth.

“The Mongolian Government prioritizes enhancing the legal environment surrounding SME development, improving SME access to finance and boosting SME competitiveness” Secretary of State Battulga said, mentioning policy measures that are seen crucial in fulfilling the objectives.

The agenda also includes an overview of findings from a recent survey on the issue of SME access to finance conducted by the Organization for Economic Cooperation and Development (OECD) last year, in frames of its Enhancing Access to Finance for MSMEs in Mongolia project.

As found by the survey, 5 major issues that hamper MSMEs to access finance in Mongolia are availability of data on MSMEs, loan offer (maturity, interest rate, size), collateral, process to obtain a loan and financial literacy.

“The OECD team in collaboration with the representatives of public and private sectors came up with the best policy recommendations to enhance access to finance for MSMEs”, said E.Buyanchimeg, Local consultant at OECD.

Five priority policies corresponding to the five obstacles are aligning statistics on MSMEs with the OECD SME Financial Scoreboard; diversifying the products offered by the SME Development Fund; overcoming the collateral issue by enhancing the operation of the Mongolian Credit Guarantee Fund; streamlining administrative procedures for loan applications; and improving financial education by ensuring the national strategy is tailored to MSMEs.

As such, the donor coordination meeting also facilitates a panel discussion on donors’ inputs on addressing the issues of SME access to finance.

Kh.Aminaa

Ulaanbaatar

Ulaanbaatar