Mongolia and Japan to Cooperate on Expanding Green Housing Finance

Economy

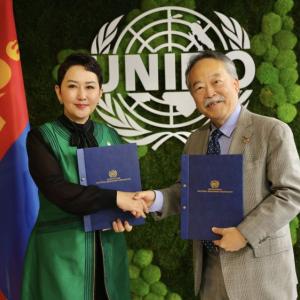

Ulaanbaatar, July 31, 2025 /MONTSAME/. The Mongolian Mortgage Corporation (MIK) and Japan Housing Finance Agency (JHF) have signed a Technical Assistance Agreement aimed at increasing sustainable green housing finance in Mongolia and developing a bond market targeting specific segments.

The Agreement, implemented under the Memorandum of Understanding signed between the two organizations in 2019 and will be effective from August 1, 2025, to January 30, 2026. The Technical Assistance Agreement includes policy development for sustainable growth, issuance of targeted bonds, capacity building, and the formulation of a transition plan aligned with international standards. It also involves training programs focused on sustainable finance, green housing, reporting standards, and digital transformation.

President and Board Member of the Japan Housing Finance Agency Yasushi Takayama stated, “Our agency, backed by the Government of Japan, has a proven track record in implementing energy-efficient and socially oriented housing loan programs. We aim not only to help establish a sustainable housing finance system in Mongolia, but also to serve as a bridge between the governments of our two countries to expand policy and financial cooperation. Localizing sustainable housing technologies may be initially challenging, but I am confident that a long-term partnership based on strong and steady cooperation will lead to success.”

CEO of the Mongolian Mortgage Corporation Gantulga Badamkhatan remarked, “This Agreement holds historic and strategic importance in advancing green building and finance in Mongolia, thereby supporting sustainable development. Through this collaboration, green standards will be introduced to the construction sector, improving quality and accessibility, while creating opportunities for green housing finance and green securities within Mongolia’s banking and financial sector. We believe this partnership will grow and lead to numerous successful projects based on mutual trust between our two nations.”

The Cooperation outlined in the Agreement is also part of a broader regional effort under the Asian Secondary Mortgage Market Association (ASMMA), of which the two institutions are members.

Ulaanbaatar

Ulaanbaatar