Financial service consumers to be protected by legislation

Economy

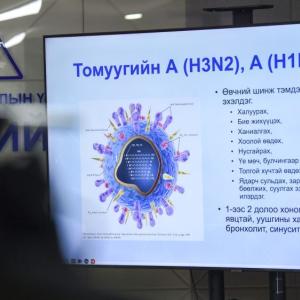

Ulaanbaatar /MONTSAME/ Bank of Mongolia (BoM) has launched a campaign ‘Protection of financial consumers’ to leverage the balance of rights of seekers and providers of financial services.

Last year the bank organized campaigns ‘Mongol Gold’, ‘Proper usage of currency’, ‘Financial literacy’ . This year, it will focus on protection of financial product consumers.

At the official launching of the program, BoM Governor N.Bayartsaikhan made a speech. “Citizens’ financial knowledge serves as the main leverage for a sustainable economy. Therefore BoM has been paying special attention to financial education of our citizens. Specifically, within the framework of public financial literacy program, we have launched the campaigns mentioned above and organized courses to educate people in the capital and provinces on financial planning, savings, loan, investment, protection against financial risks, insurance and creating pension savings. The main outcome of these campaigns would be formation of a legal environment.

As of today, banks represent 95.4 percent of financial industry. Bank is a centuries-old institution. When a herder goes to this institution for a loan, a discrepancy between their level of financial knowledge is observed, which leads to countless complaints from citizens. This calls for a legislation of a bill equalizing rights of both seekers and providers of financial services. BoM will put efforts in its realization. Additionally, Asian Development Bank (ADB) will run projects along this direction for a mutual benefit of financial service providers and citizens.”

After the financial crisis in 2008, an agreement was reached internationally that protection of consumers was of utmost importance in maintaining economic stability. Actions were taken to prevent from violation of consumers’ rights including expanding the availability of services and better monitoring.

Last year the bank organized campaigns ‘Mongol Gold’, ‘Proper usage of currency’, ‘Financial literacy’ . This year, it will focus on protection of financial product consumers.

At the official launching of the program, BoM Governor N.Bayartsaikhan made a speech. “Citizens’ financial knowledge serves as the main leverage for a sustainable economy. Therefore BoM has been paying special attention to financial education of our citizens. Specifically, within the framework of public financial literacy program, we have launched the campaigns mentioned above and organized courses to educate people in the capital and provinces on financial planning, savings, loan, investment, protection against financial risks, insurance and creating pension savings. The main outcome of these campaigns would be formation of a legal environment.

As of today, banks represent 95.4 percent of financial industry. Bank is a centuries-old institution. When a herder goes to this institution for a loan, a discrepancy between their level of financial knowledge is observed, which leads to countless complaints from citizens. This calls for a legislation of a bill equalizing rights of both seekers and providers of financial services. BoM will put efforts in its realization. Additionally, Asian Development Bank (ADB) will run projects along this direction for a mutual benefit of financial service providers and citizens.”

After the financial crisis in 2008, an agreement was reached internationally that protection of consumers was of utmost importance in maintaining economic stability. Actions were taken to prevent from violation of consumers’ rights including expanding the availability of services and better monitoring.

BoM’s campaigns are set to run for five months, and cooperators include financial service providers, Ministry of Finance, Financial Regulatory Commission, AFCCP, Mongolian Mortgage Corporation and insurance companies.

O.Onon

Ulaanbaatar

Ulaanbaatar