Revised Draft Law on Value Added Tax to Be Submitted to Parliament

Politics

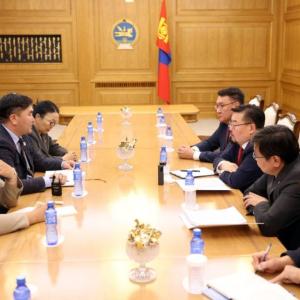

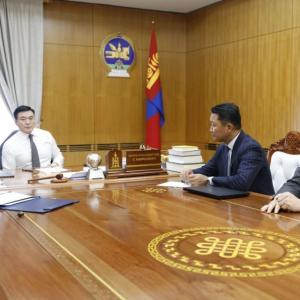

Ulaanbaatar, June 4, 2025 /MONTSAME/. During its regular session on June 4, 2025, the Cabinet of Mongolia discussed the revised draft Law on Value Added Tax and decided to submit it to the State Great Khural.

The revised draft Law on Value Added Tax was formulated with the following main objectives:

1. To reduce the tax burden on citizens and households and

protect real income. The revised draft Law reflects regulations for refunding up to 100

percent of the value-added tax paid by citizens in stages by

making discounts and exemptions more aligned with

international trends and principles.

2. To foster businesses and allow enterprises to expand

their activities. The revised draft Law includes regulations designed to facilitate favorable conditions for enterprises by reducing shortages of assets and working capital, doing

business with minimal capital cost burden, and paying fair tax. Also, as part of the goal of

supporting employment, specific tax support will be provided to support

employee development and improve human resource policies and the work environment.

The tax environment for foreign investors will be made more

favorable to increase investment and make the tax environment more competitive.

As a result, businesses will be able to attract foreign investment more easily

and at lower costs, which would contribute to an increase in Mongolia's total

investment volume and economic activity.

The revised Law on Value Added Tax would solve common problems faced by business owners, reduce the capital cost burden, and enable businesses to expand their activities. In the future, the introduction of artificial intelligence and big data-based systems will allow taxpayers to receive the necessary information promptly and resolve issues related to compliance with tax laws in advance.

Ulaanbaatar

Ulaanbaatar