Policy to Encourage Companies to be Public Promoted

Economy

Ulaanbaatar, April 12, 2024

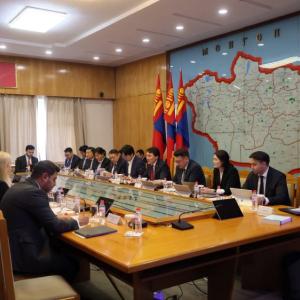

/MONTSAME/. The Financial Regulatory Commission of Mongolia and the

Mongolian National Chamber of Commerce and Industry jointly organized a

discussion on "The Advantages of Becoming a Public Company and Its Impact

on the Capital Market."

During the Discussion, information was given on the challenges

faced by TOP-100 companies in issuing stocks and bonds on the capital market,

solutions to these issues, the advantages and importance of becoming a public

company, the process of launching an IPO, and the implementation of effective

corporate governance.

The Chairman of the FRC, D. Bayarsaikhan, said in his speech, "The FRC and MNCCI jointly approved a program last year to increase the participation of TOP-100 enterprises in the capital market. We have eased the conditions and requirements for companies to conduct IPOs and issue bonds, simplified the issuance of securities, and increased participation by making necessary changes to the relevant rules and regulations. In 2023, 7 domestic companies conducted IPOs on the capital market, attracting financing of MNT 338.1 billion, while 6 companies issued open bonds worth MNT 107.5 billion. Additionally, on the over-the-counter market, 93 companies issued bonds for 151 companies, mobilizing MNT 1.74 trillion. Measures taken by the Parliament and the Government, such as the "Strategy to Reduce Loan Interest Rates," banking sector reform, and privatization of state-owned legal entities, have resulted in over 80 new financial products in the last four years, with the market valuation reaching MNT 11.65 trillion, an increase of 1.69 times compared to the previous year. Positive changes are occurring in our country’s capital market, and at a time when companies are increasingly interested in issuing securities, we are encouraging them to become public companies through IPOs, issue company bonds to attract affordable financing, actively participate in the capital market, and contribute to the development of the economy and financial sector."

At the discussion, presentations were delivered on a range of topics including the current state of the capital market, government policies and regulations designed to facilitate corporate security issuance, business transformation strategies, the experiences and benefits of becoming a public company shared by representatives of companies that have recently completed Initial Public Offerings, and the implementation of corporate governance codes.

Ulaanbaatar

Ulaanbaatar