‘ETT’ bond and be ready for the commodity supercycle

The Mongol Messenger

Trading and

reputation of the bond

Erdenes Tavantolgoi, a Mongolian state-owned joint-stock company,

has launched a three-phased trading of ‘ETT’ bond to raise MNT 2 trillion. The

first phase trading of the bond was organized between March 30 and April 9,

raising MNT 677.7 billion. It means that the planned target of MNT 600 billion

has been exceeded by 13 percent.

Stock market analysts explain in many ways what the value

and advantages of the ‘ETT’ bond are. For example, firstly, the bond has low

risk because the state-owned company has issued it, and secondly, it has the

advantage of not being subject to depreciation as it is listed on the domestic

stock exchange in US dollars.

In addition, the company has been effectively managing a large-scale

construction of railway, and Tavan Tolgoi Fuel Company, and for the first time

distributed dividends of 1,072 shares, being owned by every citizen of Mongolia,

which has been a political tool for many years. It is likely to be reputable in

the sense that is a bond of the company that has matured financially and

operationally. Moreover, the Bank of Mongolia's first legal support for the

issuance of foreign exchange bonds has certainly contributed to the success of

the trade. The Bank of Mongolia has given legal support for the first time

to issue foreign currency bonds, which has certainly contributed to the

success of the trading.

In the first phase, the bonds will be repaid over a period

of 24 months and interest will be paid every six months. The nominal unit price

is MNT 100,000 and USD 100, and 973 individuals and companies participated in

the trading. In the next phases, bonds will be repaid in up to 36 months. The

first phase of trading was for the domestic investors, while the second and

third phases are expected to attract more foreign investors.

Is the

ETT bond by the government or the company?

Investment cannot be made rashly. Investing

funds on profitable variants is certainly a basic business principle. That is

why the bond with high USD and MNT interest rates is seen to be greatly

profitable to the investors and stakeholders at this time when the savings

interest rates are low. To be specific, the MNT interest rate announced by the

central bank is 6-7 percent, while the bond’s interest

rate is 10 percent. USD savings interest rate is 2.8 percent, while the bond’s USD interest rate is 6.8 percent. This is clearly a

profitable variant to stock market stakeholders.

Moreover, the bond issued by a company that

sells its main commodity, coal, at 5-6 times its mining cost can be seen as an

opportunity to get high returns without any risk.

Government securities are considered the most

reliable investment instruments. The bond issued by a company every Mongolian

has shares in is part of the ‘MNT 10 trillion

Comprehensive Plan for Health Protection and Economic Recovery’ being

implemented by the Government of Mongolia. That is how the bond is considered

to be a government security. However, Erdenes Tavan Tolgoi JSC explained, “The bond will have no guarantee from the government. The

bond issuance is based on business principles and will not affect the

government’s debt ceiling.”

The government does not guarantee the bond even

though it holds 81.5 percent stake in the company. The company will be

accountable for any future outcomes. Nonetheless, the planned target was fully

met in the first stage trading of the bond, which suggests that the

stakeholders have belief in the bond issued by a state-owned company.

Is it the

right time to issue a bond?

In connection with the COVID-19 situation, cash

outflow began to be limited, causing a certain amount of securities to be

“accumulated” at the Bank of Mongolia - which in turn, created the opportunity

for the company to use it for financing its large-scale project. During this

time when the foreign exchange reserve is at a significantly good level at the

central bank, there is no wrong in using the finances for a state-owned

enterprise that has good capacity and resources. Issuing a bond domestically

serves as a big opportunity for domestic entities to get profits from the

state-owned enterprise. It also has a positive impact on expanding the domestic

financial and capital markets.

In the past decade, 75 million tons of coal was

extracted, of which 71 million were sold on the markets. From the sales income

of MNT 9.3 trillion, MNT 6.4 trillion was the income for the last 4 years -

which shows that its profits are continuing to increase year after year.

Furthermore, MNT 1.9 trillion was allocated in the state budget through the

company in these 4 years. These are said to be indicators for how the company

has already reached a point where it is relatively stable financially and can

implement any project without any issues.

In 2021-2025, the company is projected to run

its operations with a sales income of MNT 33.5 trillion, using about MNT 17

billion for its operational costs and allocating MNT 7.7 trillion in the state

budget. Overall, the business plans and financial estimates for the coming 5

years show the company to have a net profit of MNT 11.5 trillion, with a capacity

to pay citizens MNT 1.3 trillion in dividend. This estimate is not far off from

reality, explained the company executives.

What will

be done with the bond financing?

With the bond financing, it is planned to

implement the country’s mega construction projects, including Tavantolgoi

thermal power plant, coal concentrator, water supply and railroad. However, a

question arises that whether MNT 2 trillion is sufficient for the

abovementioned large-scale projects, otherwise there is a risk that it will be

ineffective as the bond financing is spent on many projects. For this matter,

the company explained that the projects have been internationally certified,

with detailed blueprint, preliminary budgets and proven estimation of benefits.

The projects are deemed to be possible to recoup their initial investment in a

short period.

Moreover, there are several foreign investors

who are interested in investing some projects. It can be seen as an opportunity

that has been opened up for Mongolians to participate in such profitable

projects.

It is also estimated that transportation

expense would decrease in addition to drastic increase in the sales revenue

with commissioning of Tavantolgoi-Gashuunsukhait railroad at the end of 2022.

Mongolia started supplying over 60 percent of coking coal need of China, which

was just 17 percent last year, in this time where China’s ban on Australian

coal continues. Although Mongolia is located closer to China compared to other

suppliers, expenses on auto road transport and coal washing and concentrating

processes raise the coal price, emphasized the experts. It means that there is a

necessity to launch the construction projects.

The demand to

be ready for the supercycle

Economists and experts suggest that the post COVID-19 world economy is likely

to contract to a great extent, however, the economic capacity of China will be

enhanced. This economic growth of China will serve as a foundation to help grow

the revenue of the company, whose shares are owned by every citizen of

Mongolia.

International experts also see that the “commodity

supercycle” that characterizes the mining commodity prices lies ahead of us.

Price surges on the world’s copper, iron ore, and gold markets, which hit

10-year record high this year, outline a positive outlook for this industry.

The fact that Mongolia’s primary coking coal

export market and only client - China is forecasted by international economists

to lead the global market in the world in the aftermath of the pandemic is good

news for us.

Although being dependent on one country in terms of sales and the lack of multiple export clients impose a disadvantage, China is already not “far” from us, having announced to promote its sustainable energy production. Thus, we are in need of fully utilizing this opportunity. To achieve that, Erdenes Tavantolgoi JSC is compelled to build its capacity and resources and be prepared for the next supercycle.

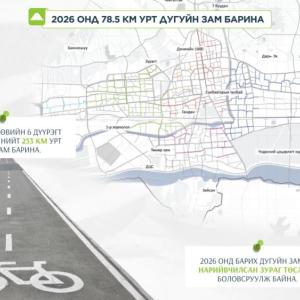

Ulaanbaatar

Ulaanbaatar