How did Mongolia get off the money laundering watch list in record time?

Society

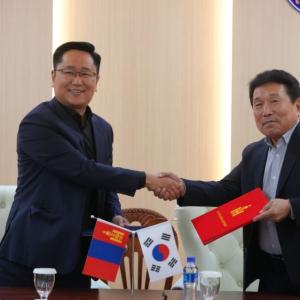

Mongolia worked with development partners and donor nations

to craft a plan that pro-actively pursued policies on anti-money laundering and

combating the financing of terrorism

Every year an estimated $2.6 trillion is lost to corruption

worldwide. This fraudulent conduct undermines the rule of law, impedes economic

development, and diverts scarce resources from schools, hospitals, and other

essential services.

Developing countries in Asia are on the front line in the

fight against this societal scourge. One strategy that these countries use to

battle corruption is to join international agreements and adopt standards that

help stanch the money that flows into and out of activities such as tax

evasion, trafficking, and other crimes.

An important facet of this work relates to policies on

anti-money laundering and combating the financing of terrorism, or AML/CFT.

Countries ignoring these two initiatives face serious internal and external

consequences, such as higher costs of doing business and of banking

transactions, as well as de-risking, where entities exit certain relationships

as they are unable to manage potential AML/CFT risks involved.

Despite the challenges, developing countries can make

significant progress in curbing money laundering and terror financing. Mongolia

provides an example of what works. In October 2019, the country was placed on

the “grey list” by the Financial Action Task Force, a global money laundering

and terrorist financing watchdog group. Being on this list means that there are

strategic deficiencies in the country’s regimes to counter money laundering,

terrorist financing, and proliferation financing that need to be addressed.

Within 12 months, Mongolia was off the list. This was

extraordinarily quick for a developing country to undertake the reforms and

actions needed to get off the grey list, particularly amid a pandemic.

Combating money laundering and terror financing is extremely

complicated, requiring international expertise across a wide range of

government and private sector activities. Working with development partners who

have expertise in this area is key to an informed response. Mongolia leaned

into their network of experts to develop an effective strategy.

Mongolia worked with development partners and donor nations

to develop a plan that was in line with its action plan under the International

Co-operation Review Group, an initiative of the Financial Action Task Force

that works with countries at high risk of being compromised by money laundering

and terror financing. These are some of the world’s top experts in the

area.

They also brought together private sector professionals from

various sectors, such as real estate agents, accountants, dealers in precious

stones and metals, lawyers and notaries, to cooperate with training and adhere

to new reporting requirements.

Mongolia’s leaders brought to the task a focus on

cooperation, political will, and a willingness to adapt and learn new

procedures. This leadership allowed Mongolia’s government agencies to

concentrate on the changes needed for maximum results at the fastest possible

time by efficiently utilizing resources.

With clear, pre-determined goals to conserve time and

resources, and the Ministry of Finance taking ownership of and responsibility

for the response they were able to get multiple agencies moving quickly in the

same direction.

Some developing countries make the mistake of waiting until

they are pressured by the international community to address money laundering.

Mongolia did not take this path. When there were indications that it would be

put on the grey list, the country’s leaders immediately undertook actions to

begin studying and addressing the issue.

By the time Mongolia was placed on the grey list, the

country’s central bank and financial regulatory commission were already

addressing its anti-money laundering and terror financing deficiencies. Because

of this proactive work, instead of the expected 20 or so issues to be pointed

out by the International Co-operation Review Group, Mongolia only had to

address six key items.

Mongolia’s experience provides important lessons for other

countries facing similar issues with money laundering and terror financing. For

one, participation in international agreements and covenants are important but

lasting change can only happen when reforms benefit a country’s citizenry.

Anti-money laundering efforts should not be seen as

arbitrary new bureaucratic procedures being imposed from outside the country.

These changes decrease corruption, increase transparency in extractive

industries such as mining, strengthen the rule of law, improve the operation of

government, and improve the lives of the public in myriad other ways.

It is important to communicate these benefits to the public because people are more likely to support reforms when they understand them. And when it comes to the expertise needed, development partners have sent a clear message to developing countries: You can rely on us. We have your back.

By Declan Magee, Carlo Antonio Garcia

Source: blogs.adb.org

Ulaanbaatar

Ulaanbaatar