Discussion takes place on development of corporate bond market

Economy

Ulaanbaatar /MONTSAME/. Since the stock market was established in Mongolia 29 years ago, 16 domestic companies have put their bonds on the market, gathering an investment of MNT 25.6 billion.

However, corporate bonds of other countries in the East Asian region take 2 or more percent of the country’s GDP. The unsatisfactory performance for our country compared to the abovementioned statistic was highlighted at a seminar organized under the theme, ‘Development of Corporate Bond Market and its Regulation’ on January 16.

The seminar participants correlated this situation to various factors, such as the domination of commercial banks in the financial sector, no institutional investors to buy corporate bonds, insufficient data and information due to no assessment of companies’ performances, and non-existence of investment funds, and discussed methods to develop the corporate bond market.

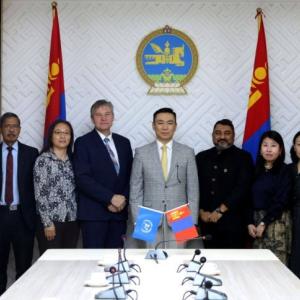

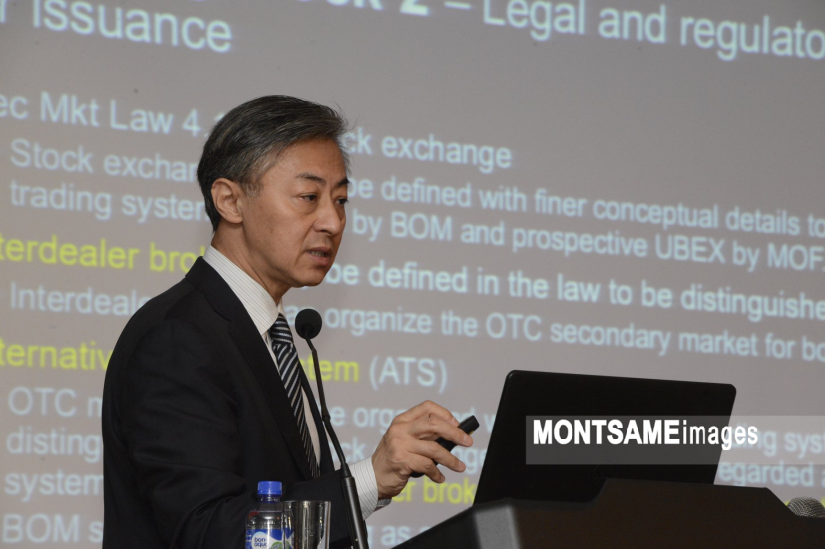

Thus, it was announced that Phase II of the project, ‘Capacity Building for Capital Market in Mongolia’ implemented by the Japan International Cooperation Agency (JICA) is focusing on developing the corporate bond market.

Project consultant Akamatsu Noritoko said, “If there is no corporate bond market, the banking sector would naturally dominate the sector not only in Mongolia but also in other Asian countries. Corporate bonds have also been found to be in the form of closed loan agreements. Furthermore, the large difference between the interest rates of loans and savings is due to the weak development of financial intermediary services, becoming another factor to have a negative impact on the corporate bond market.”

He then continued on to say, “The bonds in Mongolia have always been short-term, closed agreements, which could be more suitable to be considered as loans instead of bonds. In a way, this displays how weak the current corporate bond market is. One factor to positively affect bonds in Mongolia is to develop private pension funds, which will have a direct impact on the market.” Phase II of the project, ‘Capacity Building for Capital Market in Mongolia’, being implemented by JICA is to continue until February 2022.

Ulaanbaatar

Ulaanbaatar