Fitch rates Mongolian Mining Corporation first-time ‘B’

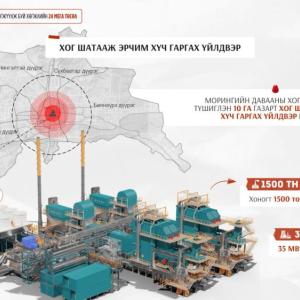

EconomyUlaanbaatar/MONTSAME/ Fitch Ratings has assigned Mongolia-based coal producer Mongolian Mining Corporation (MMC) a Long-Term Foreign-Currency Issuer Default Rating (IDR) of 'B'. The Outlook is Stable. Fitch has also assigned a 'B(EXP)' expected rating with expected Recovery Rating of 'RR4' to MMC's proposed US dollar-denominated senior notes.

MMC's rating is constrained by its small scale, single-product focus and

limited cost competitiveness outside of northern China. However, MMC has

flexibility in capex, which should give it sufficient buffer to continue

generating free cash flows during a coal price downturn.

The proposed notes will be co-issued by MMC and its wholly owned-subsidiary,

Energy Resources LLC, and guaranteed by most of its operating subsidiaries. The

notes will constitute senior unsecured obligations of MMC as they represent the

company's unconditional and irrevocable obligations. MMC intends to use the net

proceeds from the proposed note issuance to refinance its existing secured

notes and part of its perpetual notes. Concurrently, the company expects to

fully repay the senior secured loan with cash generated from its Baruun Naran

mine operations. The final rating on the proposed notes is subject to the

receipt of final documentation conforming to the information already received.

MMC is relatively small compared with Fitch-rated coal mining companies

globally in terms of revenue size, with revenue of USD590 million in 2018. MMC

operates two mines with production concentrated in the Ukhaa Khudag mine in

South Gobi.

Source: Fitch

Ratings

Ulaanbaatar

Ulaanbaatar