M.Chimeddorj: Practicing stricter financial discipline is important to beat economic troubles

The Mongol Messenger

Economist and researcher M.Chimeddorj gave an interview for the MONTSAME News Agency on the current situation of Mongolian economy and financial difficulties and etc.

We all know that the Mongolian economy is currently facing ongoing slight recession. As a person who analyses economic matters, how do you evaluate the economic crisis in the making and what are the ways to overcome it?

Mongolian economy is mainly based on primary sectors of economy and mining exports make up a larger portion of the state budget. Therefore, the economy is much sensitive to changes in the cost of raw materials, which causes budget expansion due to price growth, further leading to more negative impacts. One of the reasons of slow economic growth and troubles in some sectors is a price drop of raw materials on the world markets and on the other hand, inaccurate policy on the state budget.

What changes are needed in budget revenue and spending in order to maintain long-term sustainable development?

As I have said before, during the times when the state budget is greatly dependent on natural resources prices, it can be very risky to broaden budget along with the price increase. The budget should not be expanded complying with the increase in budget income. Shortly, we need to practice financial discipline to approve deficit-free budget. If so, we could have a revenue accumulation of wealth fund for natural resources, which could sustain long lasting economic growth.

Economic experts and researchers are suggesting a variety of versions. What is your view on the most precise step to reduce budget expenditure?

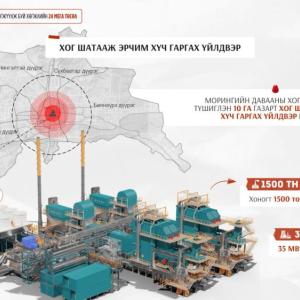

It needs to be considered that increases of social welfare spending cannot be decreased back. With a view to boost long term profits, budget investments should only be spent on infrastructure developments that are vital to ensure economic benefits. In particular, the government should invest in the most profitable and important projects in the first place by putting all state-funded infrastructure projects into order in terms of their gains and significance.

Considering the repayment period of government debts is due, much burden is to be imposed on the budget. IMF Stand-By Arrangement program or loan from China is being considered. What is your position on this issue?

The government has raised a plenty of money from the international markets when the country’s economic growth rate were flattering and commodity price was high. Unfortunately, because of faults in the policy and situation of the world economy, trust in the Mongolian government has been deteriorating. In that regard, a need of restructuring – to reorganize the debt or postponing the debt payment arises. Some people believe that the government should get additional debts and repay when the economy recovers from the present situation. In addition, some economists push for austerity measures to overcome the obstacles.

In my personal opinion, Mongolia should be involved in the IMF’s Stand by economic program and correct its policy errors. Furthermore, as a country with an economy based on natural resources, more the debt amount increases, less opportunities to amend its domestic policy flaws. Many experts are concerned that projects to be implemented by the Chinese credits would chiefly involve foreign or joint companies and necessitate a larger number of foreign work forces. Regarding to this, Mongolia would get much less economic benefits from the credits.

Loan interest rates in Mongolia are too high. A series of discussions to lower them are taking place. What do you suggest in favor of lower rates?

Again, financial discipline is the main thing in short for reducing the interest rates. Because the expansion of the budget policy affects monetary policy and even further becomes a basis of monetary policy rate to increase.

Some experts tell opening foreign banks in Mongolia would increase competitions among commercial banks, which then leads interest rates to diminish. For instance, Bank of China is looking to open in Mongolia. How do you see that?

Foreign bank branches can be opened in Mongolia. But now is not the time. 94 percent if the financial system of Mongolia is composed of banking institutions. However, there is a lack of competitiveness. Therefore, firstly, the capital market must be strengthened through establishing an accumulation fund in order to become capable of influencing interest rates. Second, the size of commercial banks should be enlarged by a way of increasing their capital. As a result, competitiveness among commercial banks could be maintained, lowering interest rates. But we should discuss this issue when proper environment are formed for foreign banks to open.

When coming to a conclusion, budget-effective policy and financial discipline are the most important aspects. How do we achieve that?

We should admit that the electoral system of the country somewhat makes a difference to the budget policy. Also, improving independence of government systems and its working principles are the main issues in terms of country’s good governance. In addition, budget policy should be free from populism and unrealizable social welfare promises need to be stopped during the elections.

B.Ariunzaya

The interview is featured in the Mongol Messenger 's issue No.43 for October 28, 2016.

Ulaanbaatar

Ulaanbaatar