Infrastructure for Connectivity and Economic Diversification in Mongolia

Economy

Ulaanbaatar /MONTSAME/

Mongolia needs more selective infrastructure investments that target key value

chains in order to drive growth, lower costs, and boost the competitiveness of

the country’s economy, according to a new World Bank report released today.

The report, Infrastructure for Connectivity and Economic Diversification, analyzes Mongolia’s infrastructure

needs and investment priorities in the context of the country’s geospatial

characteristics, fiscal challenges, and the government’s economic

diversification agenda. It focuses on five key value chains that are likely to

generate the greatest demand for infrastructure services: the livestock

industry, value added mining, tourism, renewable energy, and digital

services.The focus on these selected value chains does not imply, however, that

other sectors should be neglected; it means that these areas are likely to

generate the scale of demand for infrastructure services to shape national

investment decisions.

“Infrastructure is the

backbone of Mongolia’s economy, yet a ‘build and they will come’ approach would

limit economic returns on investments. Instead, infrastructure investments

should be prioritized to unlock new drivers of growth,” said Andrei Mikhnev,

World Bank Country Manager for Mongolia. “In addition to the mining sector,

which has so far been the predominant driver of economic growth, priority

should be given to unleashing growth potential in the livestock, tourism, digital services, and the renewable

energy sectors.”

Mongolia’s population is small

relative to the country’s size, limiting the range of economic activities in

which it has a comparative advantage. The report finds that targeted investments

in meat and iron beneficiation infrastructure have the highest potential to

accelerate growth and reduce the country’s logistics cost, which stands at a

high of 30 percent of GDP.

To improve the meat value

chain, the report suggests establishing a network of strategic hubs in

Ulaanbaatar and eight provinces with the highest concentration of meat and milk

production. Priority should be given to upgrading key parts of the 4,300

kilometers of roads connecting these strategic hubs. Concentrating services in

these hubs would reduce waste, ensure unbroken cold storage chains, and add value

through ancillary services.

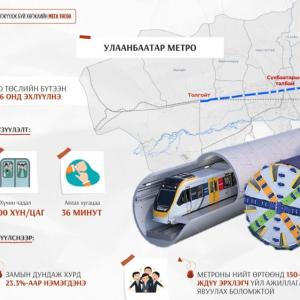

The report argues that

improving urban mobility in the capital city will be crucial to promoting

tourism and other services. Improvements in urban mobility should focus on

construction, maintenance, and operations of Ulaanbaatar’s 1,190-kilometer road

network.

As the country enjoys a strong

backbone of digital infrastructure, the report suggests that priority in this

area should be given to strengthening gaps in internet capacity and access,

improving last-mile connectivity, and expanding 4G connectivity in rural areas.

In the mining sector,

selective infrastructure investments can unlock the latent potential of several

mineral value chains. For instance, supplying power to the mines, which

currently only get 44 percent of their power supply from the grid, with the

remainder coming from auto-generation or imports. This offers a major

opportunity for a large revenue base of creditworthy, long-term power

customers.

Similarly, privately financed

mining projects could contribute to building shared railway infrastructure that

is open to multiple uses and users, according to the report. Given limitations

in public budget for infrastructure, Mongolia must leverage more private

financing for developing needed infrastructure by improving the regulatory

framework and investment climate. Efforts should be prioritized on turning the

concessions list of projects into a market-facing credible list of

well-prepared projects, which would help the government redirect its focus to

priority projects and pique investor interest.

Finally, efforts must be made to develop Mongolia’s institutional infrastructure for the selection, planning, and implementation of infrastructure projects. The report recommends establishing a central unit to better manage highly fragmented investments and lack of coordination among agencies.

Source: World Bank

Ulaanbaatar

Ulaanbaatar