Sluggish growth, soaring inflation to persist in Mongolia in 2022

Economy

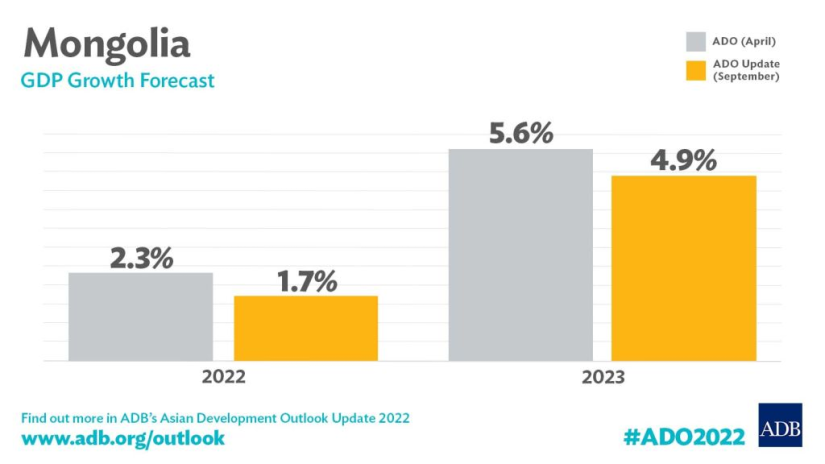

Ulaanbaatar/MONTSAME/. Economic growth is forecast to remain

low in Mongolia this year before picking up next year, assuming external risks

are mitigated and border issues with the People’s Republic of China (PRC)

resolved in 2023, according to a new report by the Asian Development Bank

(ADB). Meanwhile, inflation and the current account deficit are expected to

outpace earlier projections.

Growth is forecast at 1.7 percent this year, down from an

April projection of 2.3 percent, while the forecast for next year has been

lowered to 4.9 percent from 5.6 percent, according to Asian Development Outlook (ADO) 2022 Update,

released today, September 21. This is due to prolonged border restrictions,

deterioration of purchasing power under persistently high inflation, higher

borrowing costs, a likely decline in the availability of credit, and a

continuation of monetary tightening.

“Despite initial signs of recovery, the economy’s near-term

growth prospects remain uneven,” said ADB Country Director for Mongolia Pavit

Ramachandran. “A combination of persistently high inflation and a large current

account deficit creates a pressing need for achieving better macroeconomic

balance while focusing on medium-term structural reforms.”

The prolonged restrictions at the border with the PRC as well as the Russian invasion of Ukraine have disrupted trade, reduced essential imports, increased import prices, escalated price increases, and dampened industrial sectors and business sentiment. Contraction continued in the mining, manufacturing, construction, and transportation sectors, and recovery in industry is likely to take time. Still, the lifting of pandemic-related restrictions since February 2022 has revived domestic demand, assisted by accommodative monetary and fiscal policies.

Inflation escalated and remained above the central bank’s

target for the past 16 consecutive months. The surge in inflation will

continue, mainly due to persistent supply disruptions, rising transportation

costs, exchange rate depreciation and its pass-through impacts, and higher

prices for food, fuel, and imported durables. The current account deficit will

exceed ADO 2022 forecasts in both years, mainly because of higher

imports, lower growth expected in the PRC, and continued downward corrections

to exporting commodity prices.

Downside risks to the outlook are any new restrictions at

major trade portals with the PRC, a decline in mineral commodity prices,

negative spillovers from the global slowdown, aggressive monetary tightening,

or rising balance sheet risks in the domestic financial sector.

Source: ADB Mongolia

Ulaanbaatar

Ulaanbaatar