Total Assets of Banking Sector Rise by 15 Percent

Economy

Ulaanbaatar, September 4, 2025

/MONTSAME/. Mongolia's banking sector remains relatively stable and

continues to grow, with total assets increasing by 15 percent compared to the

same period last year.

During the presentation of the

Banking Sector’s Semi-Annual Review for 2025, Executive Director of the

Mongolian Bankers Association, Amar Lkhagvasuren, highlighted that

bank-issued loans continue to play a significant role in supporting economic

recovery.

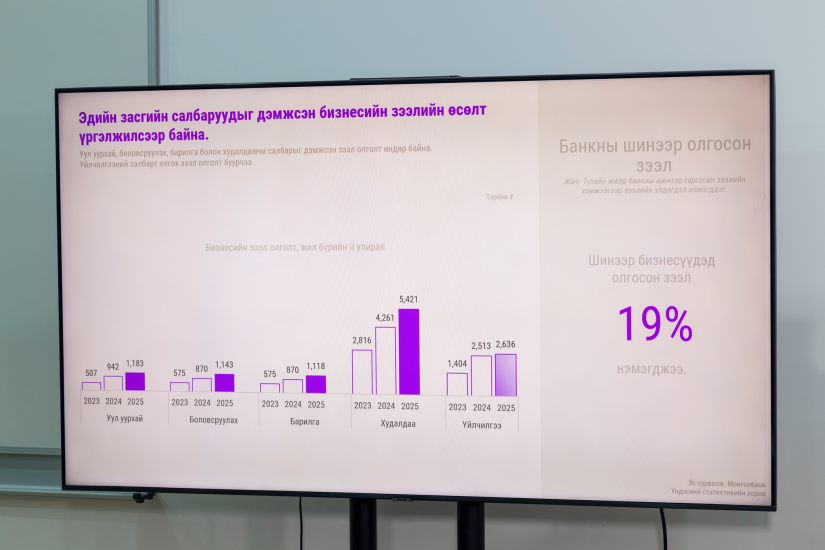

Moreover, newly issued loans to

businesses have increased by 19 percent year-over-year. As a result, the share

of non-performing business loans has declined, and both individuals and

enterprises have begun shifting their funds into term deposits. Despite the

depreciation of the Mongolian tugrug, public confidence in the national

currency remains strong, which has contributed to a 15 percent increase in tugrug-denominated

deposits.

Mongolia’s economy grew by 5.6

percent in the first half of this year. The agricultural sector has demonstrated

a strong recovery, becoming the primary driver of economic growth. In contrast,

the mining sector performed below expectations, which negatively impacted

related sectors such as trade and transportation, thereby slowing overall

growth. Additionally, the decline in commodity prices has led to a reduction in

export volumes, placing pressure on the national currency.

Revenue from taxes on mining

products has decreased by 12.3 percent, contributing to a decline in overall

budget revenues. Recurrent expenditures continue to account for the majority of

total government spending, and the fiscal balance currently shows a deficit of MNT

758 billion.

Senior Economist at the Banking

and Finance Academy, Sosorbaram Chingel, emphasized, “When formulating the

state budget, it is essential to carefully assess both internal and external

risk factors, ensure coherence between fiscal and monetary policies, and

support the real economy. Otherwise, we risk creating a system in which the

recovery of one sector leads to the decline of others.”

Ulaanbaatar

Ulaanbaatar